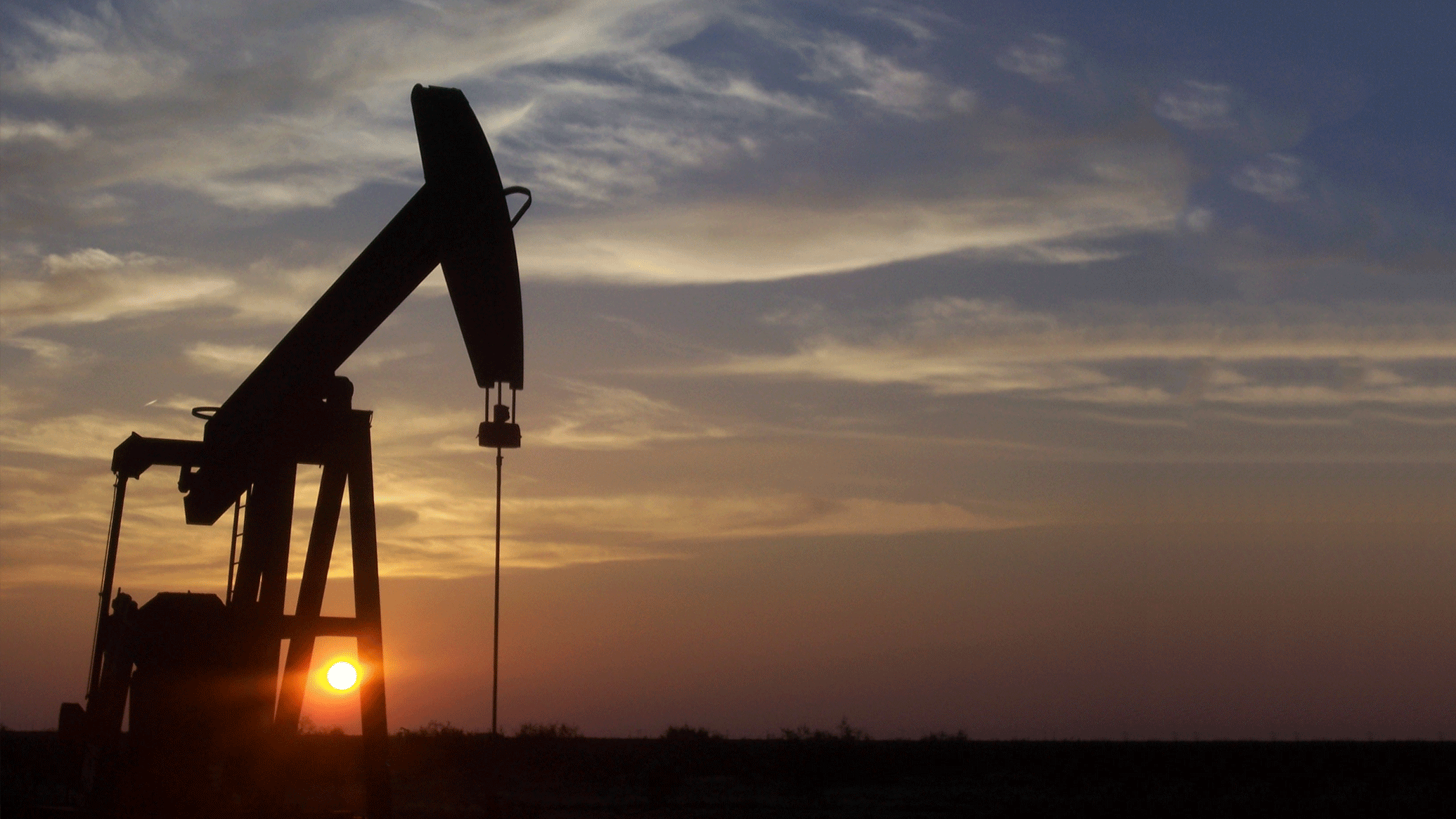

It’s time for oil investors to start taking electric cars seriously.

In the next two years, Tesla and Chevy plan to start selling electric cars with a range of more than 200 miles priced in the $30,000 range. Ford is investing billions, Volkswagen is investing billions, and Nissan and BMW are investing billions. Nearly every major carmaker—as well as Apple and Google—is working on the next generation of plug-in cars.

This is a problem for oil markets. OPEC still contends that electric vehicles will make up just 1 percent of global car sales in 2040. Exxon's forecast is similarly dismissive.

The oil price crash that started in 2014 was caused by a glut of unwanted oil, as producers started cranking out about 2 million barrels a day more than the market supported. Nobody saw it coming, despite the massively expanding oil fields across North America. The question is: How soon could electric vehicles trigger a similar oil glut by reducing demand by the same 2 million barrels?

That's the subject of the first installment of Bloomberg’s new animated web series Sooner Than You Think, which examines some of the biggest transformations in human history that haven’t happened quite yet. On Thursday, analysts at Bloomberg New Energy Finance weighed in with a comprehensive analysis of where the electric car industry is headed.

Even amid low gasoline prices last year, electric car sales jumped 60 percent worldwide. If that level of growth continues, the crash-triggering benchmark of 2 million barrels of reduced demand could come as early as 2023. That's a crisis. The timing of new technologies is difficult to predict, but it may not be long before it becomes impossible to ignore.

(bloomberg.com)

www.ann.az

Follow us !