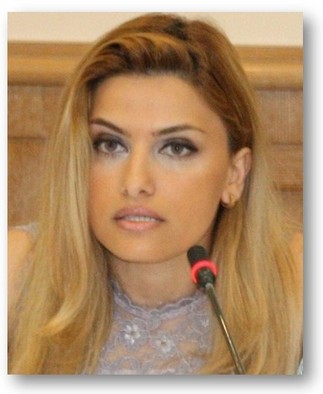

At the Flame natural gas conference in Amsterdam, the Netherlands, Natural Gas Europe had the chance to catch up with Gulmira Rzayeva, Senior Research Fellow at the Center for Strategic Studies of Azerbaijan, as well as research associate at the Oxford Institute of Energy Studies.

Last December, Russia's state-owned Gazprom announced a bombshell decision to abandon the South Stream project and to launch the so-called Turk Stream, which would deliver gas to and through Turkey to the Greek border. Given that Turkey is a partner in the Southern Corridor project that will transport gas from Azerbaijan and maybe eventually from other countries, how would you describe the strategic approach of Azerbaijan given the new geopolitical landscape?

The Turkish Stream will not change anything in terms of volumes, nor in terms of tightening the market. This is because there will not be any new volumes coming to the market, except for the 3 bcm that Turkey and Russia agreed to import for Russia, which will happen out of necessity. This is because demand is increasing very rapidly, and even 2 years ago we predicted that the Turkish natural gas market may face supply shortages in 2015-17, before Shah Deniz gas comes to the market by 2018 – so for those three years, Turkey did not have sources from which it could increase its gas imports, and could face supply shortages because of the growing demand.

This 3 bcm is crucial for Turkey to avoid facing this gap.

This should not pose any threat to either phases I or II of Shah Deniz, because that gas has already been contracted and sold. Reversing the development is simply impossible, so it's no threat to Shah Deniz, nor for the Trans Anatolian Pipeline (TANAP) in terms of transportation, at least until 2021-22, as it will be operating as planned for 16 bcm: at the first stage 10 bcm+ for Europe and 6 bcm for Turkey.

However, in 2021 it's expected that an additional 5 bcm of gas from the Absheron field in Azerbaijan can come online. The project's operator is Total, who is developing it together with SOCAR and GDF Suez. It is intended to be transported to the Turkish market via, by that time, existing infrastructure: TANAP and an expanded South Caucasus Pipeline, and if they agree with the buyers, it can be transported by the Trans Adriatic Pipeline (TAP) to Europe.

If Russian gas arrives before Absheron gas, and those parties would like to transport it via TANAP; it is the pipeline that will be operated in accordance with international laws and regulations, so I think that the partners will look at any offers coming from shippers, because this could add some value to the financial visibility of the project. TANAP is expected to be expanded to a second stage in 2024 for some 26 bcm of gas.

Will it be worth it for the partners to invest in an expansion? That's one issue they should consider, so I think the priority for SOCAR, which now owns 58% in TANAP, and who is the decision maker, as well as for BP, would be gas from Azerbaijan: Absheron.

The TAP project will be operated according to European regulations; it will be exempted for 10 bcm for Shah Deniz gas.

How realistic is it then to consider the prospect of Russian gas flowing through TAP?

The pipeline technically can be expanded to 20 bcm, so this 10 bcm is not exempted for Azeri gas, and if another shipper, namely Gazprom or any other, were to come with the offer to transport an additional 10 bcm via TAP then the TAP consortium is obliged to consider this offer and to see if it's financially viable for them to invest, and if it is they will have to do that.

The thinking here is that hopefully Absheron gas will come before any other gas from other sources. But who knows what the potential market will be for Absheron gas, because for the partners whoever offers a good price for the gas that's where they will sell it, so there is not only BOTAS and Turkey but a few private companies there that also import gas – some 10 bcm from Russia – and they are also potential buyers. Perhaps they will offer a much better price than the European customers, and because gas in Turkey will end up much cheaper than in Europe, this could be better financially to place these volumes into Turkey instead.

Private companies in Turkey have one issue that they have to secure licenses for importing gas from non-Russian gas, so this is another question that I think is solvable. The other option for the Absheron gas is SOCAR may wish to buy out all the gas from the consortium and add to its gas export portfolio. In this case, they may offer a lower price but the consortium would reduce all the risks that may occur in transportation all the way to Turkey or Europe.

Has this altered the balance a bit for other sources of gas that could flow in the Southern Corridor project, like from Turkmenistan or Iran?

Turkmen gas coming to Europe is still on the agenda, at least for Turkmenistan and the EU. It's quite an important issue for both and they are holding meetings about this, but there are still problems with the Trans Caspian Pipeline that need to be solved and when this will happen, nobody knows because negotiations started back in 1995 and are ongoing.

I don't think that the transport of Turkmen gas, at least 'til the Turkish – European border, from an infrastructure point of view, will be a problem, because the infrastructure that Azerbaijan and its partners are building, investing billions of dollars. The good news is that it's quite flexible and can accommodate additional volumes, so expansion of the South Caucasus Pipeline will be of course for Shah Deniz gas, but there are plans to further expand it – so called "future expansion" – if there is gas available for transport, if it's financially attractive and worth investing in the expansion, then this will happen.

TANAP is the same – it's also scalable and can be expanded up to 31 bcm in three stages. SOCAR and its partners investing in this infrastructure is not only good for the gas producers, but also very good for Europe as well because without this infrastructure Europe would have another major concern as to how to bring this gas from Turkmenistan in the future, or from Iran, to the market.

What are your thoughts on Iranian gas?

If they decide to export it and this is feasible it would be much better for Iran to export its gas because it's in the south of the country. In the form of LNG to world markets would be much better in terms of economics than going all the way to Europe with pipe gas.

We don't know what the Iranian decision will be. Before Iranian gas comes online, if they make the agreement in June and final accords sanctions will be lifted. Following that, they will need 7 years from now to develop and produce this gas. So it won't be there tomorrow. Seven years in the gas industry is not so long, but for Iran exporting this gas to its neighboring countries like Egypt, Oman, Jordan would be better than going to Europe.

But, if for geopolitical reasons Iran wants to go to Europe or to Turkey, then the infrastructure within the country should be developed for bigger volumes and Iran could have two options: to go to the north to Azerbaijan and from there to transport it via the South Caucasus Pipeline, then TANAP and either leave it in Turkey or go further on to Europe; or the second option is to go to Turkey and from Turkey via TANAP to transport to the European border. Again, this brings up the same issue regarding expansion of the pipeline if it's feasible. And then if they wanted to go to Europe, I think if there are large volumes then TAP will not be enough to accommodate all the Iranian gas volumes, so if feasible TAP could be expanded beyond 20 bcm, but this would be looping or a second pipeline – again, it all depends on economics.

So many factors have been in play recently – Ukrainian crisis, Iranian situation, end of South Stream, beginning of Turk Stream – numerous dynamics and various potential sources. How do you see the role of Azerbaijan moving forward amidst so much going on?

Despite this very challenging time in terms of energy and the gas industry specifically, and we are living in a very changeable environment – it's also a changing landscape because of the current low oil price, demand stagnation in many markets, etc.

Azerbaijan within the region is probably one of the few countries which, despite all these difficulties, has initiated this project and is investing billions and is continuing to pursue this multi-billion dollar project to supply some gas to Europe.

While other energy majors are decreasing their investments or scaling back, we are increasing ours and creating opportunities for such an investment, not only in Azerbaijan itself but also in Georgia, Turkey, Greece, Albania and Italy. So this is a good opportunity for investment for other European majors in this challenging environment.

I think this is something that needs to be taken into account by European policymakers, because I think that they need to be a bit more active in helping us to pursue these projects. We are taking all the financial and technical risks, materializing these projects with our partners, but they have to take all the responsibility for solving, for example, regulation issues that arise in Italy; we still have some problems in Italy, that are created artificially by lobbyist organizations or those interested in impeding the project in Italy, with other countries paying the price for such activities. The EU should be more active in preventing such things or addressing regulatory problems.

Energy security has a price, as does European energy security – Europe has to pay for it, as does everyone else.

Regarding Azerbaijan's role in what I would call "energy turmoil,” yes, it's a difficult time, but, on the other hand, it's increasing the importance of Azerbaijan – we are emerging as an important gas exporter country, as in the '90s or early '00s when we initiated the Baku-Tblisi-Ceyhan oil pipeline and the role of Azerbaijan and Turkey gradually increased vis a vis oil. Now we are witnessing almost the same or even on a bigger scale with natural gas – we're emerging as an important gas exporter country for Europe, and Turkey is gaining a position as a very important gas transit country. It's paradoxical, because until now Turkey has been playing the role of transit country only with Azeri oil and, in the future, gas. Now, Turkey is also emerging as a main gas and oil trading center with Azeri oil and gas – in the future, it will be more, coming from a number of countries, but this is what we managed in a very close partnership between Azerbaijan, Turkey and Georgia.

With the prospect of Turk Stream being floated, how has this affected the very close relationship between Turkey and Azerbaijan?

Turkey is a country that has its own ambitions, which is very understandable. If it wants more pipelines going through its territory, it's understandable and normal. Of course we regard it as Turkey's own business and it's Turkey who decides how to use its territory. There's never been any confusion or problems in regards to other suppliers when we entered the Turkish market; it's competition and competition is good, so I don't think it can cause any confusion between two countries.

TANAP is also a Turkish project as Turkey's Botas has a 30% stake in the project, and of course it's in the Turkish interest as well to have this pipeline come before any other similar pipelines that could be materialized in the country.

Finally, could you tell us a bit about what you've been working on?

We've just finalized a report on the Azerbaijani gas industry, which is more than 100 pages on the outlook for Azerbaijan's gas supplies in the 2020s and in the 2030s. We are looking at all the fields and prospective structures in Azerbaijan beyond Shah Deniz, which of course is also included. The focus of the paper is non contracted free gas that could potentially be available for export in Azerbaijan in the future.

(www.naturalgaseurope.com)

www.ann.az

Follow us !