New pipeline to triple Azerbaijani gas piped to Europe, avoiding Russia

Construction or preliminary work has begun on three pipelines designed to flow natural gas supplies from Azerbaijan to consumers in Turkey, Bulgaria, Greece and Italy, according to the Energy Information Administration (EIA). The South Caucasus Pipeline Expansion (SCPX) is proposed to take natural gas from Russia, Central Asia and the Middle East to consumers in southern Europe.

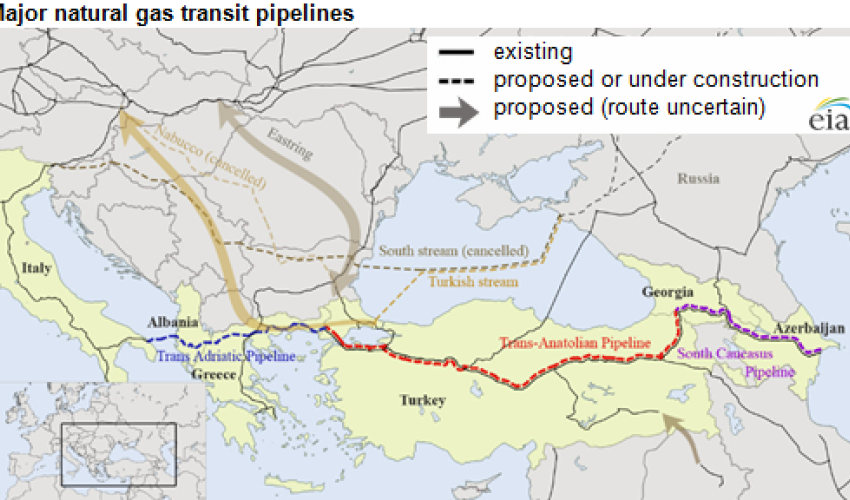

Over the past decade projects including Nabucco, which was planned to transport natural gas through southeastern Europe to connect with existing natural gas pipelines in or near Austria, South Stream, proposed to carry gas out of Russia and into Bulgaria and eastern Europe, have been cancelled. The future of Turkish Stream, the proposed alternative to South Stream that would land in Turkey rather than Bulgaria, also remains uncertain, with Russian state-owned monopoly Gazprom (ticker: OGZPY) cancelling its contract with Saipem (ticker: SPM), the Italian company contracted to lay the first part of the pipeline.

Construction began on the SCPX pipeline, which runs from Azerbaijan to the Georgia-Turkey border, at the end of June. It will connect with the Trans-Anatolian Natural Gas Pipeline (TANAP) from there and continue to the Turkey-Greece border, which officially started construction in March 2015. The final portion of the pipeline, the Trans-Adriatic Pipeline (TAP), which is expected to begin construction in 2016, will take the gas from the Turkey-Greece border to Italy.

SCPX will incorporate two pipeline loops for a total distance of 487 km (303 mi), while TANAP is expected to stretch 1,850 km (1,150 mi), and the final portion of the pipeline runs 870 km (540 mi) to its final destination in Italy. The total distance of the project will be 3,207 km (1,993 mi).

20 billion cubic meters of gas per year

SCPX and TANAP are scheduled to start operations by 2019, with plans for start-up on TAP set for 2020. Turkey and Italy have contracts to receive 0.6 billion cubic feet per day (Bcf/d) and 0.8 Bcf/d of of natural gas, respectively, while Greece and Bulgaria each are contracted to take 0.1 Bcf/d.

The original South Caucasus Pipeline (SCP) was built to export Shah Deniz gas from Azerbaijan to Georgia and Turkey, starting from the Sanggachal terminal near Baku, Azerbaijan, and following the Baku-Tbilisi-Ceyhan (BTC) crude oil pipeline through Azerbaijan, Georgia and Turkey, where it is linked to the Turkish gas distribution system. The SCP Co. shareholders are BP (ticker: BP; operator, 28.8% interest), AzSCP (10.0% interest), TPAO (19% interest), Petronas (15.5% interest), Lukoil (10.0% interest), NICO (10.0% interest) and SGC Midstream (6.7% interest).

According to BP, the expansion project will involve the construction of two new compressor stations in Georgia, which will triple the gas volumes exported through the pipeline to over 20 Bcm per year.

Avoiding Russia

Although historically an oil producer, Azerbaijan’s importance as a natural gas producer and exporter is growing. Until 2007, Azerbaijan was a net importer of natural gas, largely dependent on imports from Russia. Azerbaijan was also dependent on Russia as a transit country for its oil exports until 2006. The Baku-Tblisi-Ceyhan oil pipeline, which began operating in 2006, and the South Caucasus Pipeline, which began operating in 2007, provided transportation capacity out of the Caspian region that did not rely on crossing Russian territory.

European markets are increasingly looking for new sources of natural gas as relationships with Russia turn sour. New projects like SCPX have put more pressure on Russia as its pivot to Asian markets has proved to be less fruitful than it had originally hoped. "Russia is realizing the situation, and having to adapt their strategy in Europe,” Dr. James Henderson of the Oxford Institute for Energy Studies told Oil & Gas 360 in an exclusive interview.

Other proposed pipelines

Plans are also in the works to build a bidirectional pipeline called Eastring from Slovakia, through Hungary and Romania, connecting to Turkey through the existing Trans-Balkan pipeline. Future possibilities for moving natural gas to Turkey and Europe also involve natural gas exports from Iran and Iraq. The lifting of sanctions on Iran would allow European countries to import gas from Iran. Although Iran already exports natural gas to Turkey, it has long had plans to export larger volumes of natural gas through Turkey to Europe. However, other hurdles would remain, including agreeing on a natural gas price and meeting Iran’s growing domestic demands for natural gas, especially for enhanced oil recovery, power generation, and winter heating.

Turkey continues to negotiate with the Kurdish Regional government and the Iraqi government on building a natural gas pipeline from northern Iraq to Turkey; while no agreement has been reached, BOTAS, Turkey’s state-owned pipeline company, has begun extending the domestic natural gas transmission system to the Iraqi border.

www.ann.az

Similar news

Similar news

Latest news

More news

Photo

Photo

Video

Video