Prospects for the World Economy in the Year of 2019

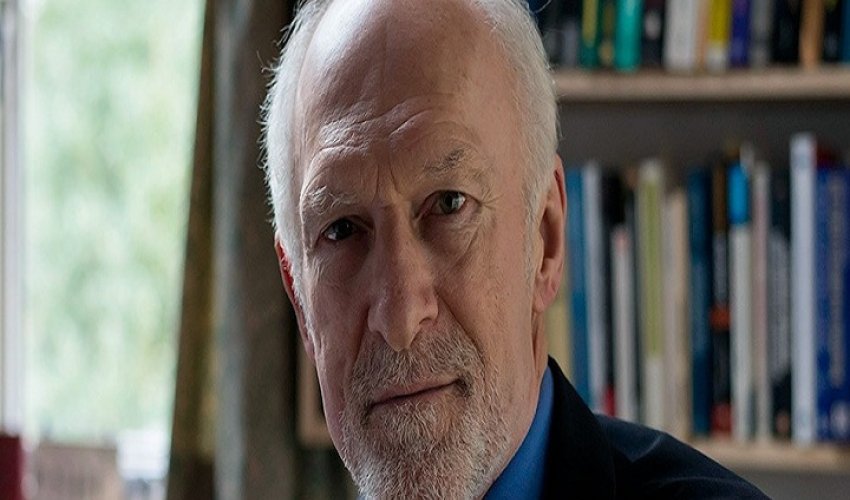

By a British Economist and Professor of The University of Sheffield, Andrew Tylecote who will be visiting Azerbaijan for the first time to teach on the University of Sheffield's Executive MBA Program delivered now in Baku.

2019 is the Year of the Pig, for the Chinese. I am happy to say,

for

them the

pig

symbolises good fortune and honest hard work. Well, there will be much honest hard work this year, but the prospects for good fortune are somewhat clouded. Some of the clouds are Chinese.

The key to prosperity is debt: it is difficult to get companies and individuals to spend heavily, and particularly to invest heavily, without an increase in debt to fuel the boom. The problem with debt is that after a point, those who it is safe to lend to have borrowed as much as they can afford. After that, the extra loans will mostly go to those who a wise bank would not lend to. This applies within countries and between them. The 1980s were called the Lost Decade in Latin American countries because in the 1970s their businesses and governments borrowed heavily from the newly-rich Middle Eastern oil producers, who could find no-one safe to lend to. At a

certain

point the borrowers became

virtually

insolvent , and had to spend a decade or more paying down their debts.

The clearest sign that these countries would hit trouble was their balance of payments deficits on current account: they were spending (on imports) much more than they were earning on exports, and much of the difference became extra debt. (In the early 2000s I used to point out to my Greek students the massive current account deficit that their country was running, and ask them how long they thought this could go on for. If Greece is very lucky, it will only have lost one decade.)

The good news is that such balance of payments imbalances are more modest than they were. Until the oil price collapse in 2014-15, a number of oil producers had massive surpluses, beyond what they could spend, while many oil importers were ‘balance of payments constrained’ because of the high oil price. China,

Japan

and Germany also had very large surpluses. The United States was one of those running a large current account deficit. The US government was a safe enough borrower even then, but there were other US borrowers that weren’t.

And then came shale oil and gas, and the oil price fall whose main cause was shale. Now the US deficit is considerably smaller, and the US economy is better balanced: High oil price? The oil and gas producers spend heavily on investment. Low price?

The American consumers have more money left to spend after filling their tanks. The US can now look back on ten years of steady growth, and there is no sign yet of recession. Its economy should be able to ride out the spat with China. Oil

exporters

of course have

smaller

surpluses , if any. China and Japan do too.

The worst single problem is inside economy no.2: China. The last big Crash, of 2008-9, helps understand China’s problems now. The US had a debt mountain, internally – mostly Americans lending to Americans. The crisis that caused, brought about a shocking recession, but at least it ended with a smaller debt mountain than before. The Chinese also had a debt mountain – not so large – but to avoid ‘catching’ the American/Western recession, the Chinese central government threw everything they had at their economy. That is to say, they ‘persuaded’ local government and state-owned enterprises to spend on no matter what – just spend. And borrow as required. So now their mountain is comparable to America’s of 2008. They can scarcely repeat their 2009 policy. But if they can’t make economic peace with the United States……Let us hope this Pig has good nerves.

Professor Tylecote will be visiting Baku

by

end of March to deliver Business Economics Unit to the students of the Executive MBA Program of the University of Sheffield.

www.anews.az

Similar news

Similar news

Photo

Photo

Video

Video