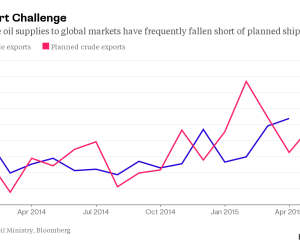

Oil slumps 4 percent, nears new six-year low as glut persists

Oil prices tumbled almost 4 percent on Thursday, accelerating a slump that threatens to test new six-and-a-half year lows, with traders unnerved by a persistent rise in U.S. stockpiles and a downbeat forecast for next year.

Benchmark Brent crude fell below $45 a barrel for the first time since August, its sixth decline of a seven-day losing streak of more than $6 a barrel, or 12 percent, in a slump that will vex traders who thought the year's lows had already passed.

The latest decline was triggered by data showing that U.S. stockpiles were still rising rapidly toward the record highs reached in April, despite slowing U.S. shale production. Weekly U.S. data showed stocks rose by 4.2 million barrels, four times above market expectations.

In its monthly report, OPEC said its output dropped in October but at current levels it could still produce a daily surplus above 500,000 barrels by 2016.

Brent futures LCOc1 settled down $1.75, or 3.8 percent, at $44.06 a barrel. The tumble of the past week has left Brent less than $2 away from its August lows and a new 6-1/2 year bottom.

U.S. crude futures CLc1 finished down $1.18, or 2.8 percent, at $41.75. Its low in August was $37.75.

"We're going to have a lot of oil on our hands with the builds we're seeing, talk of rising tanker storage and the yawning discount between prompt and forward oil," said Tariq Zahir at New York's Tyche Capital Advisors.

"If we breach the lower end of the trading range, we could open the trap door to break $40 in the days and weeks to come."

U.S. gasoline futures RBc1 were also battered, tumbling 4 percent, despite a weekly draw in the motor fuel's stockpiles. Heating oil futures HOc1 sank 3 percent from an unexpected inventory hike due to unseasonbly warm weather.

The storage spike has sharply widened prompt crude's discount to oil slated for later delivery as traders hold more in hopes of selling at higher prices later. On Thursday, prompt U.S. crude's discount to the second-month was at its largest since the end of April. CLc1-CLc2

Oil traders are also watching global tanker traffic carefully this month amid signs that unsold crude may be accumulating on the water.

Reuters shipping data showed tankers with nearly 20 million barrels of Iraqi oil due to sail to the United States in November, potentially the largest import wave in years, while dozens of tankers are already queueing off the Texas coast.

(Reuters)

www.ann.az

Similar news

Similar news

Photo

Photo

Video

Video