We see a big potential of the non-oil sector – Mustafa Abbasbayli

Сaspian Energy

(CE): Could you please tell in detail about the proposals the Club submitted to

His Excellency President of the Republic of Azerbaijan, Chairman of the Caspian

European Club Ilham Aliyev? Which sectors of economy did the proposals cover?

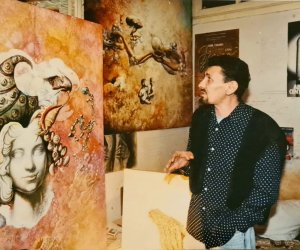

Mustafa Abbasbayli,

Member of the Board and Head of the Legal Committee of the Caspian European Club:

As you know, in February our expert committee under the Caspian European

Club (Caspian Business Club) prepared a few proposals on several areas, and as

you already pointed out they have been submitted to the President. Our proposals

consist mainly of 3 parts. In particular, these include customs, taxation and

investment climate in Azerbaijan.

CE: Which

items do the customs-related proposals include?

Mustafa Abbasbayli:

As far as the customs segment

is concerned, I would like to specify several key moments of this direction. The

first one is that we would like to offer tariffication. The proposals include

the item on tariffication of customs charges, which suggests that the Customs

Committee introduces a differentiated tariffication on imported products, in

particular those produced in Azerbaijan. That means distinguishing between Azerbaijan-made

products and those not produced in Azerbaijan. Therefore, it is necessary to

raise tariff rates for imported products that are already produced in

Azerbaijan and respectively keep the same or set lower rates for those not manufactured

in Azerbaijan. In addition, we offer to update tariffication data every year.

As you know, each year brings new service sectors, so we offer to update the tariffication-related

information every year.

CE: What could

you say about the proposals on fiscal policy?

Also, in our opinion one of the proposals in the field of taxation is to introduce the third category to taxation. The fact is that there are two main tax regimes in place in Azerbaijan now: a simplified kind of tax and a normal kind of tax. The second one envisages a tax rate for company profit at 20%. We propose to introduce the third clause on taxes for companies with the annual turnover not exceeding 50,000 manats. Thus, from the moment of registration through the first year of operation a company with a turnover of up to 50,000 manats pays no taxes. When a turnover reaches 50,000 manats or after one year of operation a company can shift to a simplified system, which envisages charging of only 4% as tax from an annual turnover.

CE: Will this

clause also cover a decrease in a tax base for individuals?

CE: Finally,

what does the third item of the proposals include?

Mustafa Abbasbayli: The third point

of our proposals includes the proposals to improve the investment climate in

Azerbaijan. As is known, in recent years, particularly since late 2015, very

important steps have been taken in this area. We, in turn, would also like to

contribute to this process by submitting our proposals.

What we would

like to suggest is to completely abolish the tax on reinvestment. That is, if a

business entity makes a profit and reinvests it, to be more exact if money

remains in a company or is invested in another sphere, this may be the case of

not charging taxes. It will help to boost investment in the real sector of

economy.

CE: How would

you evaluate the current economic situation in the country and in the region in

general?

CE: Which

area can drive the development of the non-oil sector of economy?

Along with agriculture and tourism, the transport sector is also promising. Azerbaijan is currently turning into a transit zone for the neighbouring countries. The favourable geographical location enables Azerbaijan to develop into a regional transport hub. This, in turn, will increase budget receipts and create more opportunities for the development of other sectors.

www.ann.az

Similar news

Similar news

Latest news

More news

Photo

Photo

Video

Video