One Way of Thinking about WhatsApp’s Staggering Price

And yet, by one measure, the deal might not have been absurd.After all, Facebook isn’t buying WhatsApp for its current revenue stream. The figure that matters most to Mark Zuckerberg is 450 million: the number of active users that WhatsApp says it has. Because of the network effects of social media—and because of Facebook’s healthy fear that something will usurp it—any service with an enormous user base represents an outsized threat and an outsized opportunity.Now, the term “active users” should be taken with a grain of salt, as there is no universal definition. Some companies, such as Twitter and Facebook, report monthly active users, but it’s up to the companies to determine what makes someone “active.”Nonetheless, we combed through company filings, news reports, and data from independent analytics firms to determine the number of “monthly active users” for various social Web services. We then asked: which of these user bases is most highly valued by the market? Dividing a company’s active users by its market capitalization or fund-raising valuation, we find that Facebook deemed each WhatsApp user to be worth around $42. Not only is that very similar to the implied value of Instagram’s 22 million active users at the time Facebook announced that $1 billion acquisition last year, it’s much less than the value associated with each user of Snapchat, Twitter, or Pinterest. Each of the 1.1 billion active users of Facebook (which was left off the chart so that the others could be better visualized) is essentially being valued at about $150.This is not investment advice; none of this is to say that user base alone is a wise way to determine the value of a company. But it does help explain how anyone could possibly look at a startup with $20 million in revenue and see $19 billion in value.(technologyreview.com)ANN.Az

Latest news

More news

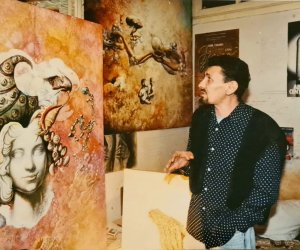

Photo

Photo

Video

Video